Acquisitions Intelligence

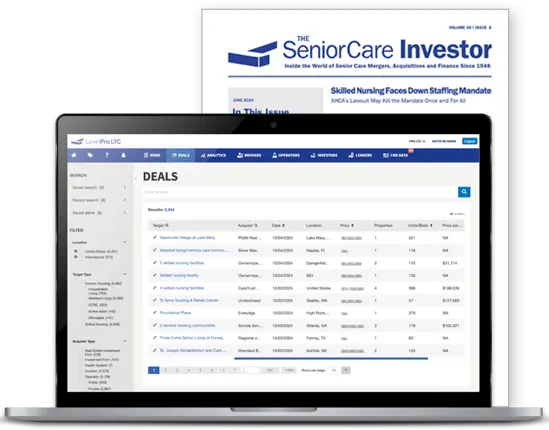

LevinPro delivers the most comprehensive coverage of Senior Care and Healthcare services M&A data and analysis

Sign up for our free eNewsletters

Sign up for our free eNewsletters

Drive data-driven decisions with key insights, valuation trends and 40,000+ deals

Access all long-term care M&A data and analysis, The SeniorCare Investor, annual reports and webinars

Access M&A data and trends across all healthcare sectors, Health Care M&A News and quarterly/annual reports

M&A Intelligence

Individual transaction details organized by key sectors including seniors housing, skilled nursing, active adult, and CCRCs

14+ Tracked Sectors

Covering seniors housing, skilled nursing, active adult, CCRCs, and 14+ key healthcare sectors

Bolstered by CMS Data

See who is growing their Medicare/Medicaid market share in your sector or local market

Check out our demo video

Get up-to-date M&A data with a focus on the healthcare and senior care industry. Find out who’s buying, what’s selling and valuation metrics across dozens of subsectors.

Learn more about LevinPro LTC and

LevinPro HC.

Up-to date and comprehensive deal data

Healthcare services and technology

Seniors housing and skilled nursing

Providing context and analysis on healthcare transactions backed by a 35,000+ deal database

30+ years of expert analysis and unique transaction & cap rate data sourced directly from market participants

Up-to date and comprehensive deal data

Health care services and technology

Providing context and analysis on healthcare transactions backed by a 35,000+ deal database

Seniors housing and skilled nursing

30+ years of expert analysis and unique transaction & cap rate data sourced directly from market participants

Learn about our award-winning M&A newsletter

Data as a building block to better performance

REITs

Rely on proprietary, privately-sourced valuation data

Providers

Use data to refine your growth and partnership strategy

Health Systems

Tap extensive hospital M&A data and valuation stats

Private Equity

Speed up diligence and sector thesis development research

Brokers/Lenders

Get deal comps, valuation trends and identify opportunities

Appraisers

Get deal comps and valuation trends

Medical Groups

Use data to refine your growth and partnership strategy

Advisors

Track subsectors and identify trends with ease

Academics

Study market structure and consolidation impacts

- Brookdale’s Portfolio Stumbles in Februaryby Steph Mallozzi on March 10, 2026

Brookdale Senior Living reported its February 2026 occupancy numbers, and if the remaining cold weather months even closely resemble what […]

- 60 Seconds with Swett: The State of the Healthcare M&A Marketby Ben Swett on March 10, 2026

I attended the McDermott Will & Schulte Healthcare Private Equity Conference in Miami Beach last week, and the buzz mostly centered […]

- Premier Care Dental Management Expands Pennsylvania Presence by Kate Humphrey on March 10, 2026

On March 9, Premier Care Dental Management announced that it was expanding its presence in Pennsylvania with the acquisition of Lebanon […]

- Resolve Pain Solutions Acquires Southcoast Spine and Pain by Kate Humphrey on March 10, 2026

Resolve Pain Solutions, a portfolio company of Compass Group Equity Partners since 2022, reported its second acquisition of the year with […]

Upcoming Webinar

March 19, 2026 | 1PM Eastern

The State of the Healthcare M&A Market

Across healthcare services, M&A activity is rising and buyer strategies are adapting to changing operating, regulatory and financial environments. Which sectors will take off in 2026? Where are valuations changing the most? And what do sellers need to know before selling?

Trusted by industry leaders