Since private equity has grown significantly since 2010, private equity healthcare deals have been flown too far under the radar. From dominating the healthcare industry as buyers or partnering with health systems, private equity has a hold on the healthcare landscape, and that’s showing up in the statistics.

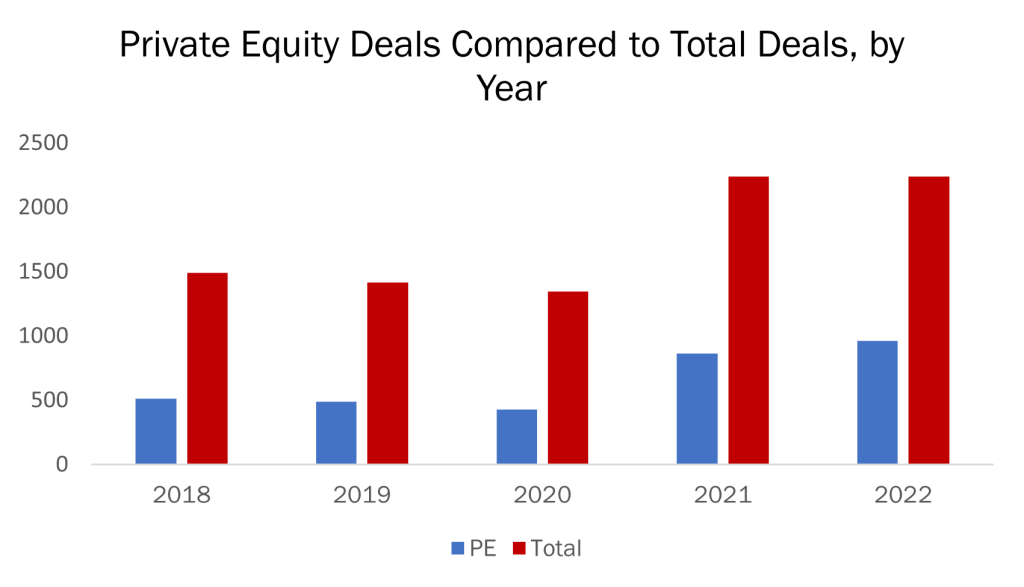

According to data captured in the LevinPro HC database, in 2010 4% of transactions were completed by private equity buyers. That percentage inclined steadily for the next several years, jumping to 31% of 1,322 healthcare transactions in 2017, and to 39% of 2,234 healthcare deals in 2021.

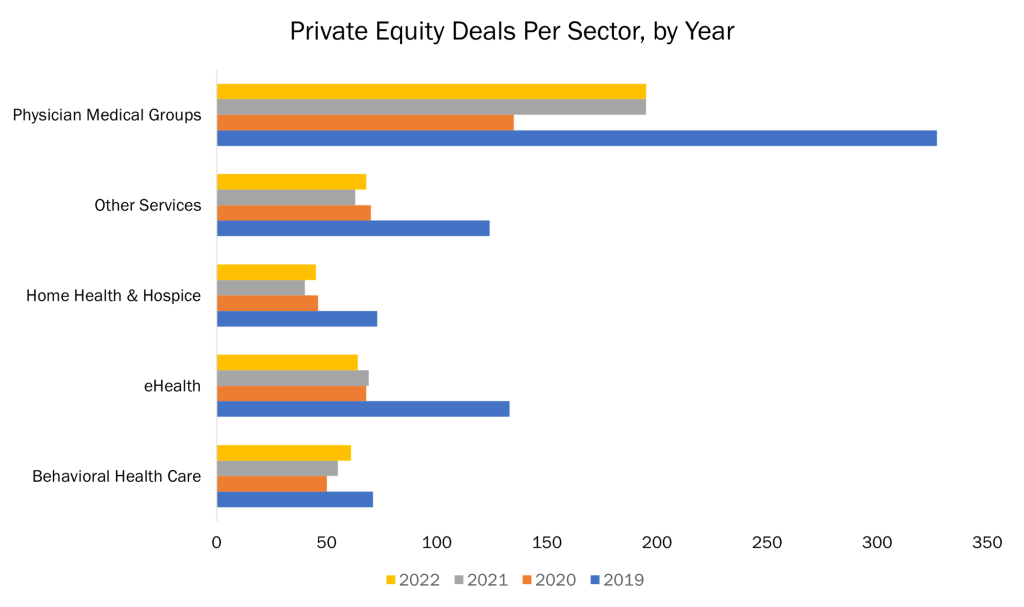

In 2022, private equity firms and their portfolio companies announced 963 transactions, accounting for 35% of healthcare M&A. A significant portion of those transactions targeted physician group, totaling 430 acquisitions, or roughly 45%. eHealth has also had a strong showing with 114 transactions, or 12%.

The least active sector for private equity healthcare deals is hospitals with only four transactions in 2022. That being said, it is important to note that while private equity M&A activity in the hospital market is not high, that does not mean private equity is not a major player. Private equity owns a plethora of behavioral health and rehabilitation hospitals and major for-profit health networks in the country like LifePoint Health.

During 2022, there were a myriad of active firms with multiple transactions. The most active private equity firm has been Charlesbank Capital Partners, completing 43 acquisitions through its portfolio company, MB2 Dental Solutions. Through these acquisitions, MB2 Dental Solutions added more than 50 practices and more than 65 physicians to its portfolio. Additionally, Charlesbank Capital Partners’ portfolio company symplr, acquired Midas Health Analytics Solutions for $340 million and GreenLight Medical for an undisclosed price. Both companies provide eHealth analytic services.

While private equity healthcare transactions often do not disclose a purchase price, the total purchase price from in 2022 totals more than $18.9 billion across 41 transactions with disclosed prices. The largest disclosed price is Clayton Dubilier & Rice’s acquisition of Kindred at Home’s hospice and personal care business for $2.8 billion.

Through the first few months of 2023, the trends are similar to 2022. Through the end of May, there have been 375 transactions reported where the buyer is a private equity firm, representing 35% of the 1,059 healthcare transactions of 2023. Physician medical groups account for the most activity at 169 transactions and Hospitals with the only one acquisition. Charlesbank Capital Partners has completed 27 transactions, Thurston Group completed 10 and Harvest Partners completed seven.

Disclosed prices total more than $17.1 billion across 21 deals, since the start of the year.

The largest acquisition by disclosed price was the acquisition of Syneos Health, Inc. (NASDAQ: SYNH) by Patient Square Capital, Veritas Capital and Elliott Investment Management for $7.1 billion. The second largest acquisition, during the time frame, is Advent International and Warburg Pincus’ acquisition of BioPharma Solutions from Baxter International, Inc. for $4.25 billion. While these two deals highlight the depth of private equity’s pockets, they also highlight how much investing power private equity has. This is especially true, considering, according to a 2022 report done by CUNY School of Labor and Urban Studies, private equity has more than $4.4 trillion in assets under management and additional $1 trillion in uninvested capital.

Source: LevinPro HC, June 2023

Scott Davis, Managing Director at Provident Healthcare Partners, offered some insights into why deal activity is so high. Davis has been at Provident Healthcare since 2014 and leads efforts across all facets of the transaction process, including business development, marketing, negotiation and due diligence.

“There are a wide range of industry tailwinds driving investors into healthcare services and those can vary from sub-sector to sub-sector,” he said.

He also spoke about how much of the industry is still highly fragmented, which can lead to inefficient business operations. Both of these factors make the sector ripe for investment with the potential to contain costs, grow revenue and expand margins. All of these components contribute to why private equity has flocked to healthcare and continue to do so.

In addition to the healthcare services industry, private equity and investors have shown a great deal of interest in the healthcare tech and life sciences markets. A 2022 report from McKinsey & Company found that biotechnology companies raised more than $34 billion globally in 2021, which is more than double the 2020 total of $16 billion.

Private equity firms are attracted to biotech, and pharmaceutical companies because of the potential for innovation in drug discovery. Companies, such as KKR & Co. (NYSE: KKR) that provide a solid foundation for drug discovery have financially benefited and are on the forefront of the healthcare market.

KKR is a leading global investment firm that manages multiple alternative asset classes, including private equity, credit and real assets, with strategic partners that manage hedge funds. Since 2004, it has invested approximately $18 billion across the healthcare market.

While other private equity firms tend to be more active in buying physician medical groups like Webster Equity Partners and Quad-C Management, KKR’s activity is predominantly centered around labs, biopharmaceuticals and the health tech industries because its seemingly endless resources allow it to shell out more with each acquisition. The company is well positioned to build upon its already impressive portfolio and fortify its position as a top private equity group.

In 2022, KKR closed KKR Health Care Strategic Growth Fund II (HCSG II), a $4 billion fund dedicated to healthcare growth equity investment opportunities.

With funds from HCSG II, KKR directly completed three acquisitions, purchasing contract development manufacturing organization (CDMO) Bushu Pharmaceuticals Ltd.; Clinisupplies, a British manufacturer and distributor of continence care products; and DDS (Drug Development Solutions), a provider of bioanalytical and analytical and materials science solutions to pharma, biopharma, consumer healthcare and consumer products clients.

According to the press release, KKR purchased Bushu Pharmaceuticals through one of its Asian-focused funds because the transaction was an opportunity to further position Bushu as a leading CDMO in the Japanese pharmaceuticals market.

DDS was purchased in tandem with Alliance Pharma, a portfolio company of Ampersand Capital Partners. KKR invested in DDS because it is positioned to be a leading global specialty bioanalysis platform, further building KKR’s strength.

To round out August 2022, KKR led a Series B funding round for Digital Diagnostics that closed with $75 million raised. Regarding the funding, Ali Satvat, Partner and Global Head of Health Care Strategic Growth at KKR, said KKR was impressed with Digital Diagnostics’ achievements and was looking forward to supporting the company in its journey to develop innovative solutions for patients, providers, clinicians and health plans. This investment was also made with money from HCSG II.

In August 2021, KKR sold Arbor Pharmaceuticals, Inc. to Azurity Pharmaceuticals, Inc. Arbor Pharmaceuticals is a specialty pharmaceutical company marketing FDA-approved prescription products in the neuroscience, cardiovascular and institutional markets.

Amit Patel, Chairman and CEO of Azurity, said, “The combination of the two companies…will create a one-of-a-kind company leveraging increased scale and diversification, a breadth of dosage forms, integrated capabilities and expanded market presence to better serve our patients’ needs.”

We can only speculate that KKR divested its Arbor assets because KKR wanted to shift its focus to different pharmaceutical companies where the possibility to scale and grow was bigger.

The following year, KKR divested its entire 27% stake in Max Healthcare, a chain of hospitals in India. It sold 260.47 million shares and raised approximately $1.09 billion from the stake sale. According to the press release, this was an optimal time for KKR to sell its stake in because Max Healthcare’s business was on an increase from its COVID-19 low.

But KKR has not divested assets before losing capital. In May 2023, Envision Healthcare Corporation filed for Chapter 11 bankruptcy and in June 2023, GenesisCare did as well.

At the time of its bankruptcy filing, Envision was a leading provider of physician-led post-acute care and ambulatory surgery services. KKR acquired Envision in 2018 for $9.9 billion, the largest KKR transaction in the LevinPro HC database.

According to the company’s press release, Envision entered into a Reconstructing Support Agreement with its key stakeholders supported by more than 60% of its roughly $7.7 billion in debt obligations.

GenesisCare is a provider of cancer care services in Australia, United States, United Kingdom and Spain. KKR purchased roughly 30% stake in GenesisCare in 2019 for $1.1 billion.

GenesisCare filed for bankruptcy protection, as it has been struggling under a debt load stemming from its 2019 acquisition of 21st Century Oncology. GenesisCare plans on separating its U.S. business from its Australian, Spanish and British operations. Additionally, the company secured so-called debtor-in-possession financing of $200 million from existing lenders to support its operations.

With these two bankruptcies coming to light, we must wonder how KKR’s reputation will be impacted. Will physicians question the validity of working at Envision and GenesisCare? Will other portfolio companies begin to question how secure they are under KKR’s tutelage?

Another private equity firm that has made waves in the healthcare industry is Chicago-based Shore Capital Partners. Shore Capital Partners is a lower middle-market private equity firm that has approximately $3 billion of cumulative capital commitments through various investment vehicles, quite different from KKR.

Since 2015, Shore Capital Partners, and or its portfolio companies, have completed 80 acquisitions, according to data from the LevinPro HC database. The majority of its acquisitions are in the Physician Medical Groups (PMG) sector, totaling 62 transactions or roughly 78%. Shore’s most active portfolio company is EyeSouth Partners, which was founded in 2017 in partnership with Georgia Eye Partners. In October 2022, EyeSouth was sold to Olympus Partners. Prior to being sold, EyeSouth Partners completed 29 deals, expanding Shore’s presence by more than 200 physicians and 30 practices.

It’s noteworthy that Shore chose now to sell EyeSouth as eye care is a busy sector and it may have been beneficial to hold onto a lucrative company, while demand for eye care is high.

In an interview, Chris Mioton, a partner at Shore, noted that Shore always intended on selling EyeSouth in 2022, representing a typical divestment schedule for many private equity groups. He also touched upon the fact that Shore’s investments focus on the lower- and mid-market, adding to why it was the right time to sell.

Additionally, with this divestment, Shore is able to shift attention towards its other industries, perhaps concentrating on dental (which is currently the most active PMG specialty accounting for approximately 32% of PMG deals in the first half of 2023). As of mid-2023, its dental portfolio includes Great Lakes Dental Partners (formally Chicagoland Smile Group), OMS360 and Southern Orthodontic Partners. Together, these portfolio companies have completed 12 transactions for Shore.

In April 2023, Shore Capital sold Innovia Medical, LLC to Inverness Graham. Shore formed Innovia in 2015 through the acquisitions of Summit Medical, Inc. and Shippert Medical Enterprises, LLC. Innovia Medical develops and manufactures surgical products for ear, nose and throat and cosmetic surgery, with a substantial footprint across the United States and United Kingdom.

By selling Innovia eight years after forming it, Shore held onto the company longer than it typically does (on average, Shore divests its portfolio companies after four to five years).

Don Pierce, Partner at Shore and Chairman of the Board of Innovia, said, “We are pleased to have supported the development of Innovia into one of the leading medical device platforms in the specialty surgical market, and we believe that the company is well-positioned for continued growth.”

With this, it can be assumed that Shore felt there was more room for Innovia to grow and divesting sooner could have cut off its growth potential.

Demographic changes and a highly fragmented market are attracting private equity to healthcare, allowing them to chase high returns and operate in a high capital cost environment.

According to Davis, private equity healthcare deals will continue to have a big impact on the industry. “[There will be] continued consolidation of healthcare providers, increasing the use of technology and innovation to improve both clinical and business performance. This will also create further downstream investment in a variety of outsourced service models aimed at achieving reduced cost and improved care with greater profit margins.”

Kate Humphrey is a writer for Levin Associates.

Levin Associates provides comprehensive coverage of the deals, companies, and trends shaping the healthcare industry. Clients access proprietary M&A transaction data and daily news/analysis through the LevinPro platform.

Schedule a demo today to see what LevinPro can do for your team.